The following simple tips will help you organize your nonprofit’s financial records at the end of the year. Some of the tips will also help you properly maintain and keep track of the financial records for the following reporting year.

When putting the nonprofit’s financials together, the first question is “where do I start”? If you are a small operating nonprofit corporation and don’t have established accounting software, you can start with summarizing the information from the bank statements:

- Organize your bank statements. Bank statements will help you extract the numbers you need to work on your nonprofit financial statements – Profit & Loss Statement and Balance Sheet.

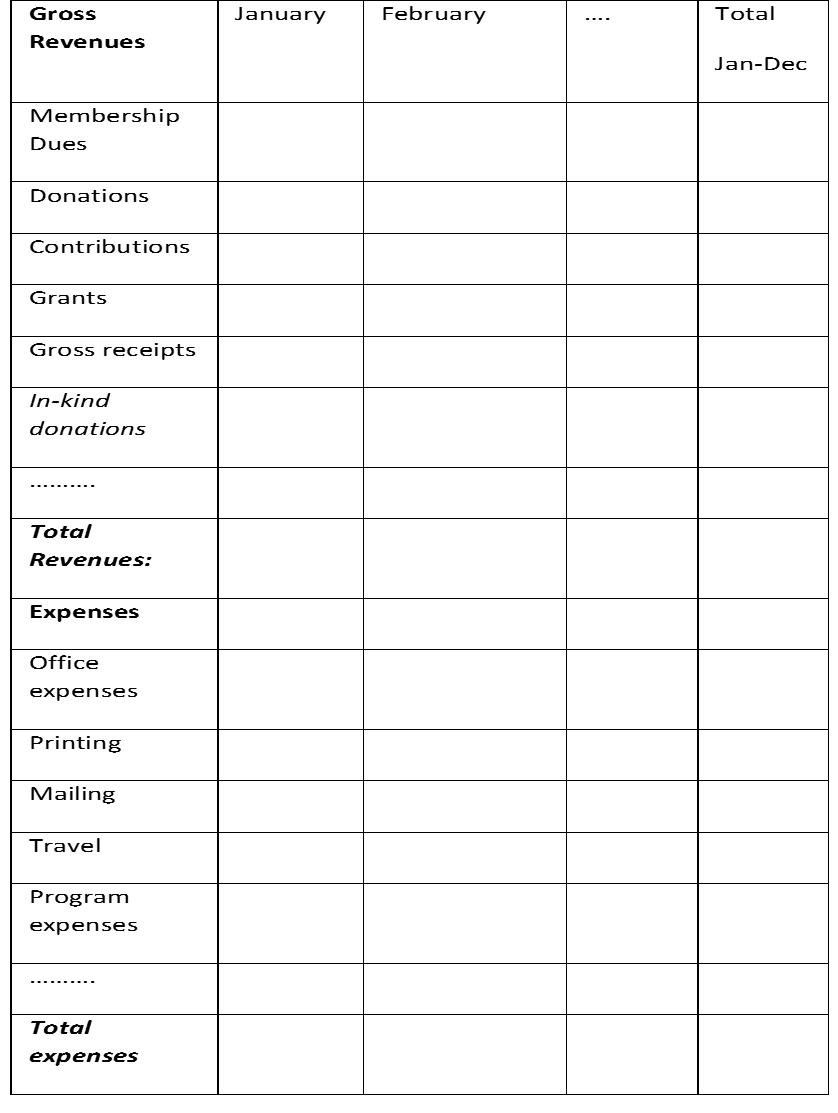

2. Next step will be to create an excel spreadsheet/table with the following information:

- Gross revenues;

- Expenses;

on a monthly basis

Please see a sample below:

You can modify the revenues and expenses categories and make them applicable for your nonprofit. Please include categories that are clear and it will make sense for somebody who doesn’t know what your organization is doing, e.g. avoid using acronyms, spell out the whole revenue/expense name.

The goal is to add the financial information in the table and to have a very good picture of the financial transactions that the nonprofit did during the year.

3. Unfortunately, the bank statements won’t bring any information on non-cash donations/in-kind donations. For that reason, some nonprofits keep copies of all receipts for donation they provide to their donors; take photos of those donations and so on. If you look at the table once again, there is a line in the Gross revenues section for you to add those in-kind donations. Try to come up with an approximate value of all in-kind donations your nonprofit received for the reported period.

4. Tip for next year! Update the information in the table above as often as possible. The more often you update the table, the easier it will be at the end of the period to summarize the financial information and create financial statements. Some organizations prepare them on an annual basis, others prepare quarterly financial statements and/or semi-annual.

5. If your nonprofit organization has already set up accounting software, please make sure you add all the transactions. Missing a transaction won’t make numbers balance at the end. Our advice is to add the transactions regularly, as they occur. Adding everything at the very last moment is always overwhelming. Once transactions are inputted – the software generates the financial reports – Profit & Loss Statement and Balance Sheet.

6. Create a list of all contributors who donated more than $5,000 or paid more than $5,000 for your organization’s services. The list should consist of their names, mailing addresses and exact amounts donated with the date;

7. Make a list with Board of Directors’ contributions – name and exact amount donated.

8. Write down if you made a donation equal to or greater than $5,000 to any one person or organization. You need to include the name of person or organization that received the donation, address, dollar amount, date of donation and indicate whether the donor was a 501c3 public charity; private foundation or for-profit business.

9. Tip for next year! Keep an updated list of all Board members that served on the organization’s board during the year. F990 requires the nonprofit organization to include the names, mailing addresses, working hours, compensation and benefits of all board members who served on the Board for the reported year.

10. Make a summary of your nonprofit’s accomplishments. What were your accomplishments? Write down all the achievements you think are significant and make your nonprofit stand out in the community. The more statistical data you provide the better. For instance: the nonprofit organized 3 workshops for approximately 50 kids from Metro Atlanta, GA community teaching them how to become productive members of the society and ways of boosting their self-esteem.

Keeping and maintaining good financial records is essential, as the tax returns are open for the public. Everyone who is interested in your charitable cause can request a copy of your nonprofit tax return. Well-organized financials, significant achievements and a clear mission statement make the first good impression on the great exempt purpose and services your nonprofit provides to the community.